us germany tax treaty summary

In most cases the US will credit the German tax against the US tax Art. Detailed description of corporate withholding taxes in Germany Notes.

Should The United States Terminate Its Tax Treaty With Russia

United States and the income from the services is not attributable to a fixed base in the United States Article 14 Independent Personal Services would normally prevent the United States from taxing the income.

. Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. Estate and Gift Tax Treaty. 61 rows Summary of US tax treaty benefits.

Us Germany Tax Treaty Summary germany summary United states and germany sign new protocol to income tax treaty summary on june 1 2006 the united states and germany signed a protocol. Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or periodic income may be exempt by reason of a treaty or subject to a reduced rate of tax. Person but resides in the UK.

United States and Germany Sign New Protocol to Income Tax Treaty SUMMARY On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty. If however the German resident is also a citizen of the United States the saving clause permits the United States to include the remuneration in the worldwide income. Definition of USCanada Tax Treaty.

Case law and treaty news from around the globe. This is is the same as if a person is a US. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income.

Global Tax and Legal Services Leader PwC United Kingdom. Exemption from the withholding or a lower rate may apply if your home country has a tax treaty with the US. It is divided into 16 provinces and its capital is Berlin.

Income payments dividends and payment in lieu from US. The Text shows the Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation with Respect to Taxes on Estates Inheritances and Gifts as amended by the Protocol to the German American Treaty generally referred to as the Germany-US. Article 4 Residence This is very important and one of the key impacts of any tax treaty.

These treaty tables provide a summary of many types of income that may be exempt or subject to a reduced rate of tax. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. There is an agreement between Germany and the United States regarding which country receives social security taxes when a person is working within Germany.

Germany has the largest economy and is the second most populous nation after Russia in Europe. If for example a person is from the UK and resides in the US. Managing Partner Global Tax and Legal Services PwC United States.

Then portions of the tax treaty will impact certain taxes such as retirement but not others. Generally a 30 rate is applied to non-US. If a person is assigned to work within Germany for 5 years or fewer by a United States company they will pay taxes into the United States Social Security system.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax. Select your summary.

Global Tax and Legal Services Clients Markets Leader PwC United States 1 646 436-6657. Corporate recipients of dividend and interest income interest on convertible and profit-sharing bonds can apply for refund of the tax withheld over the corporation tax rate of 15 plus solidarity surcharge regardless of any further relief available under a treaty. Germany is a key member of the European economic political and defence organisations.

The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty. The proposed anti-abuse provision is uniquely tailored to. For most types of income the solution set out in the Treaty for US expats to avoid double taxation in Germany is that they can claim US tax credits against German taxes that theyve paid on their income.

While the US Germany Tax treaty is not the final word on how items of income will be taxed it does help Taxpayers better understand how either the US Government andor Germany will tax certain sources of income. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. 1 4 DTC USA allows the USA to tax their own citizens regardless of the provisions of the DTC.

The complete texts of the following tax treaty documents are available in Adobe PDF format. Most income tax treaties contain what is known as a saving clause which prevents a citizen or resident of the United States from using the provisions of a tax treaty in order to avoid taxation of US. Most importantly for German investors in the United States the Protocol would eliminate the.

Germany - Tax Treaty Documents. Complete the applicable Form W-8 to find out your status. Strong measures to prevent treaty shopping The United States branch tax prohibited under the existing convention will be imposed on United States branches of German corporations for taxable years beginning on or after January 1 1991.

23 5 DTC USA. This means that a US citizen who lives in Germany will be taxed in Germany because of tax residence and in the US because of citizenship. Germany is effectively not permitted to tax on the basis of citizenship alone although it may tax a heir doneeor beneficiary domiciled in Germany receiving tangible property from a US citizen or domiciliary32 In the case of a US domiciliary who is also a Netherlands citizen Netherlands must give a full credit for US tax only if such.

The official language of Germany is German and the currency is the euro EUR. In other words a Canadian citizen who is living in the US for a work placement wont need to face double taxation. Sources into your IB account may have US.

If the treaty does not cover a particular kind of income or if there is no treaty between your country and the United States. The saving clause Art. US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons.

Read More Canada Child Tax Benefit December Payment Date canada child. Initially formed in the year of 1980 this mutual taxation agreement limits the duties between Canadian and US citizens and permanent residents that live in on the other side of the border.

What Is The U S Germany Income Tax Treaty Becker International Law

Germany United States International Income Tax Treaty Explained

Dvids News Sofa Why It S Important To You

German Rental Income Tax How Much Property Tax Do I Have To Pay

Double Taxation Taxes On Income And Capital Federal Foreign Office

Germany Adopts Substantial Transfer Pricing And Anti Treaty Shopping Rule Changes Mne Tax

The Ins And Out Of Us Taxation For German Citizens

The Shortest History Of Germany Review Probing An Enigma At The Heart Of Europe History Books The Guardian

Form 8833 Tax Treaties Understanding Your Us Tax Return

Doing Business In The United States Federal Tax Issues Pwc

German Law Removes Us S Corporation Tax Benefit

Us Military In Germany To Create List Of People Targeted By Local Tax Authorities In Spite Of Sofa Status Stars And Stripes

Donald Trump Approves Plan To Pull 9 500 Troops From Germany News Dw 01 07 2020

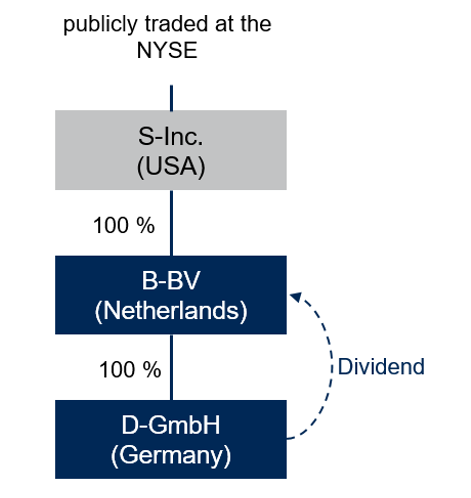

German Law Removes Us S Corporation Tax Benefit

Germany Usa Double Taxation Treaty

Ukraine Gets Compensation In Exchange For Us Germany Deal On Nord Stream 2 Euractiv Com

New German Government To Permit Dual Nationality Schengenvisainfo Com

Of Productivity In France And In Germany Le Blog De Thomas Piketty